Your Guide to Specialist Car Insurance

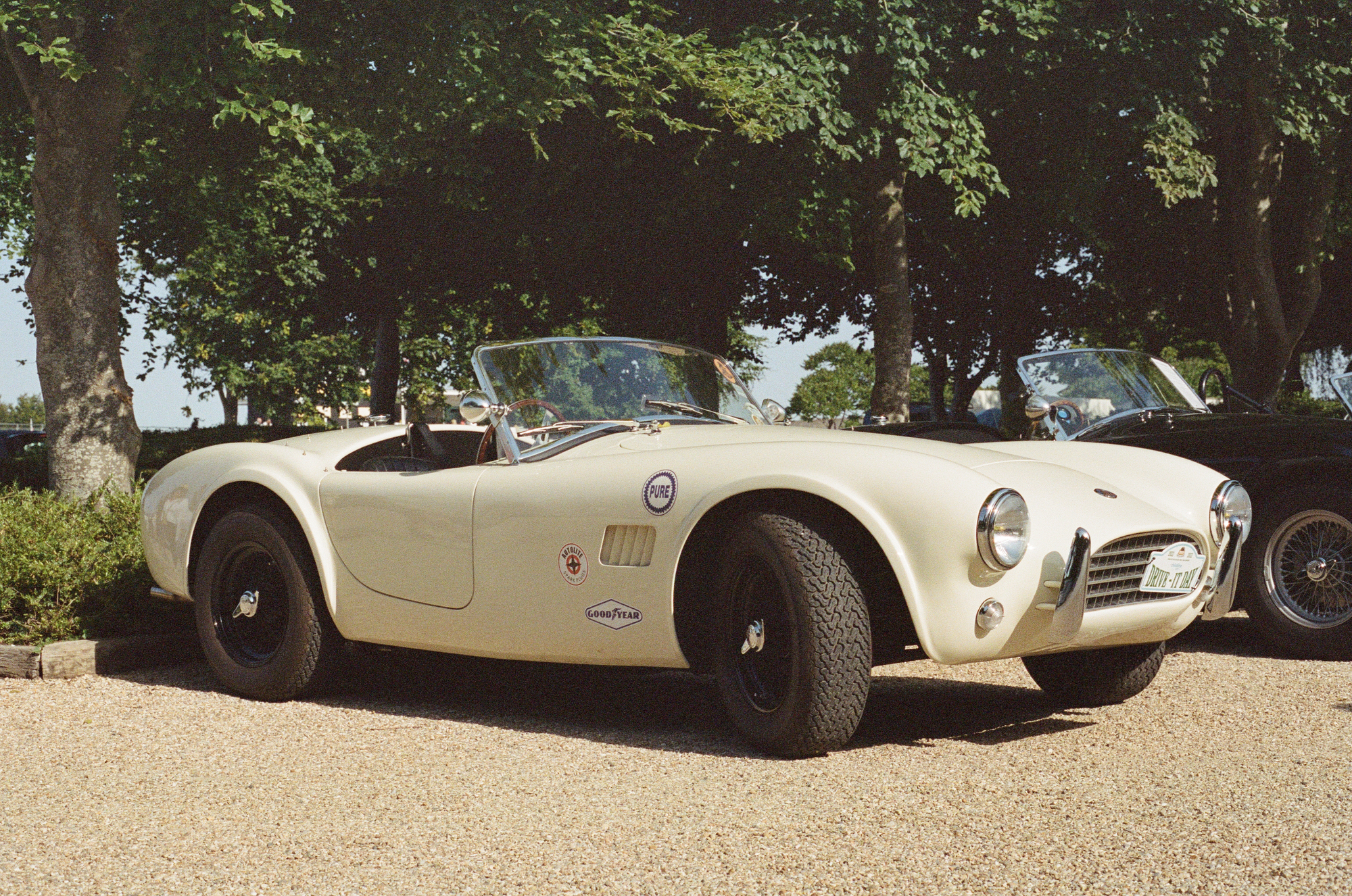

Navigating the realm of car insurance may not be the most riveting subject, but its relevance extends to everyone. It's an unavoidable necessity, often carrying a hefty price tag and demanding a significant investment of time. For enthusiasts, the frustration can reach another level, especially when you're acutely aware that you cherish and understand your vehicle more profoundly than the average driver. However, entering the world of specialist car insurance can feel like going on a blind date. You’re not sure what you’re going to get, but you’re optimistic it won’t end in tears.

Written by Archie Hill for The Apex by Custodian. Edited & produced by Archie Hill, Lewis Pickersgill, Patrick Hennessy & Jeremy Hindle.

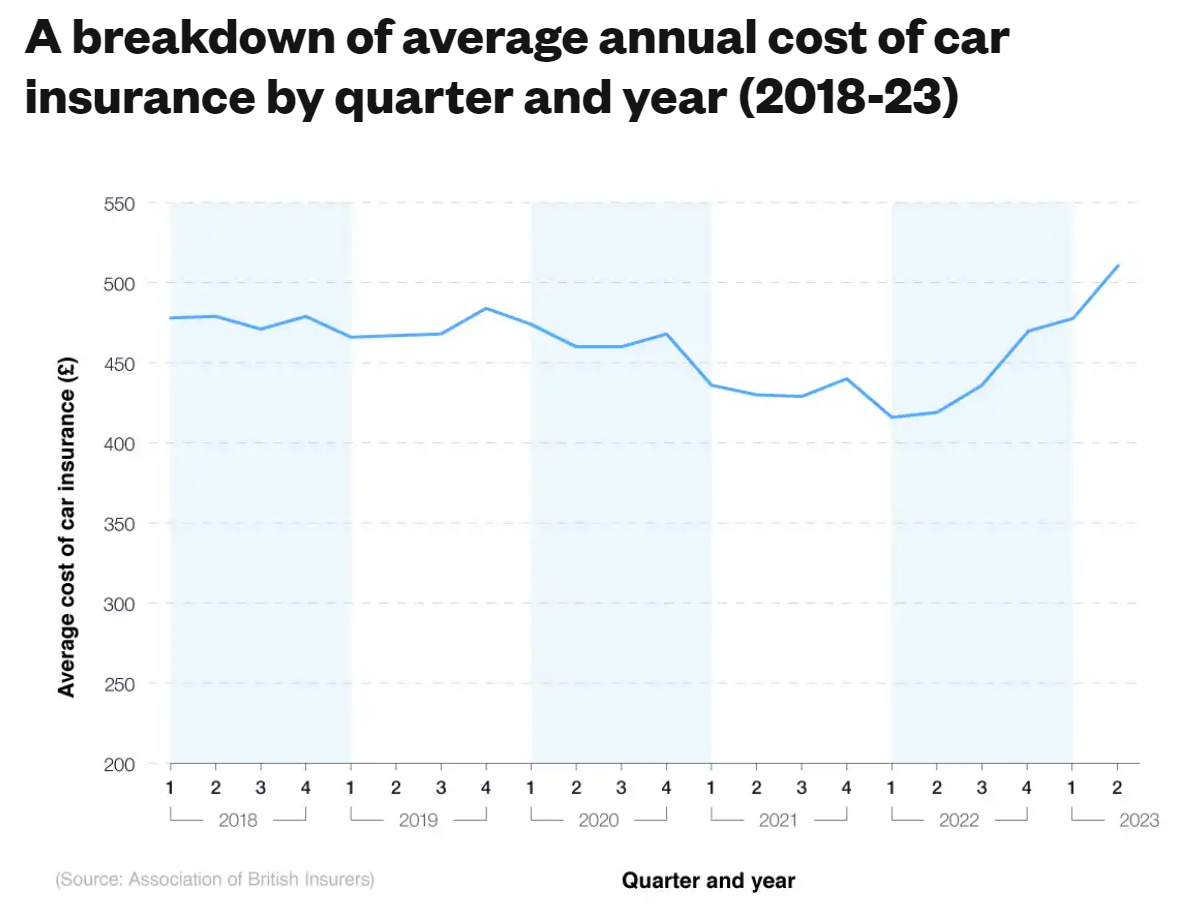

Specialist car insurance is designed for owners of prestige, classic or high-performance cars that are not typically covered by standard car insurance policies. Over the last year, premiums for these policies are up around 20% - a trend that looks set to continue in 2024.

There are a number of contributing factors, such as the increased time taken to source replacement parts. To illustrate, let’s say you have a minor accident in your Porsche 993 Carrera S. The part you need is not available in the UK, and must come from Porsche’s headquarters in Stuttgart. Their manufacturing costs are already up because of the increase in energy prices…but alas, the part is on its way! But no…the part runs into problems at the border as a result of Brexit complications. It takes longer for the part to clear customs, which means you have to spend more time in your courtesy car - a cost typically covered by the insurer. So instead of having the courtesy car for 5 days, you have it for 10.

Another reason is that the cost of reinsurance has also increased significantly for insurers. This might seem counterintuitive, but insurers often mitigate their risk by insuring themselves against very large claims, such as catastrophic head or spinal cord injuries resulting in full or partial paralysis. But why is this driving premiums skyward? Well, inflation. Inflation in the pharmaceutical, care, and medical sectors has meant that the cost of taking care of someone with severe injuries, particularly over a long period, is now significantly higher.

Theft is also to blame. Anyone who has tried to insure their car in London can attest to this. Last year, according to figures from the Home Office, the Met Police recorded 36,133 crimes of ‘theft of a motor vehicle’ from June 2022 to June 2023, up from 27,771 for the same period the year before. The increase in thefts in the capital means the number of insurers prepared to offer cover for that risk has decreased. Therefore, the insurers that are willing to offer cover can charge a higher premium for taking on that risk. They might even insist on additional security measures like fitting an immobiliser.

Well then, what are we to do? Must we resort to nihilism and be condemned like a modern Sisyphus to suffer the weight of uncomfortable premiums? Hopefully not.

There are steps owners can take to reduce premiums. For those with specialist cars in urban areas, securing a spot in a secure, non-public car park with a dedicated entrance is a good start. Though it may cost around a few hundred pounds a month (depending on location), the potential savings on premiums, and your peace of mind, could make it a worthwhile investment. Additionally, for owners in more general circumstances, the simple act of relocating your vehicle from the street to a driveway can significantly contribute to premium savings, provided it is a feasible option.

Furthermore, many classic car owners unknowingly find themselves in a situation of over-insurance, particularly regarding mileage coverage. If you’re insured for 3000 miles a year but you’re only doing half that, you could be missing out on some small but, not insignificant, savings, so it's important to regularly evaluate your driving habits and adjust your insurance policy accordingly.

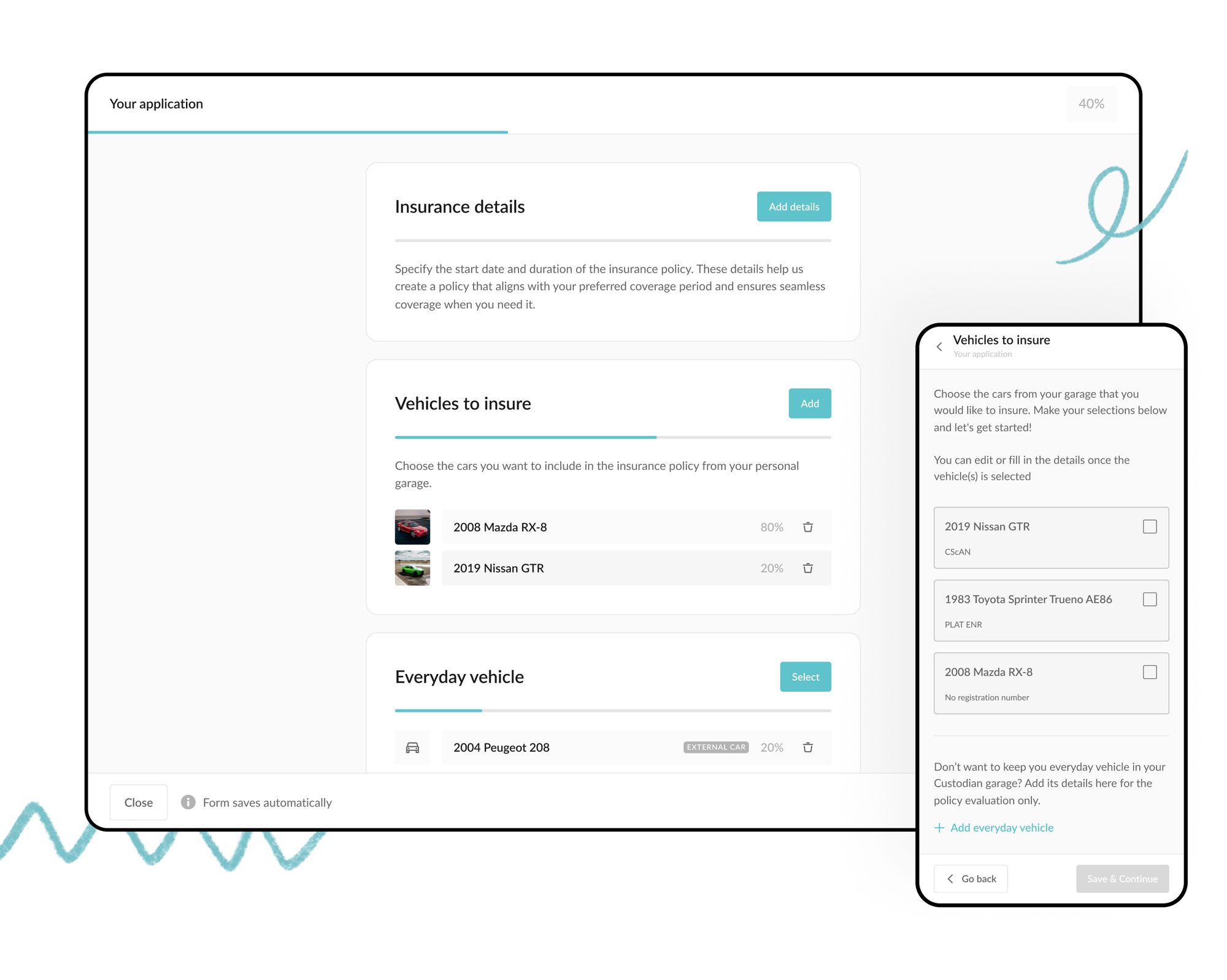

Another option is to get a quote through Custodian. We’re a little different from your traditional specialist motor broker.

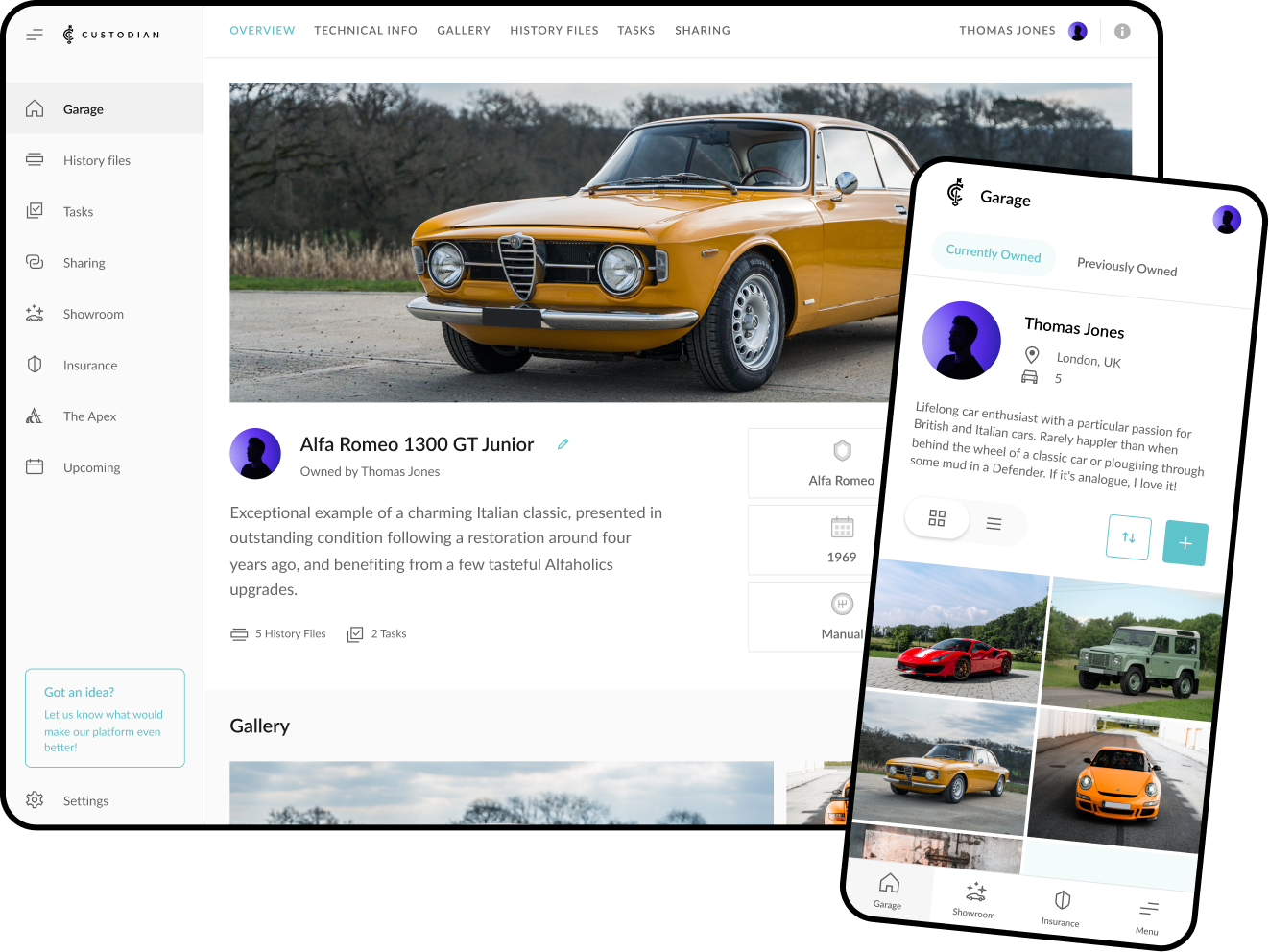

For those familiar with Custodian, you’ll know it is a platform built to simplify automotive ownership. After all, if you are the primary custodian (forgive the pun) for a classic, performance, race, or vintage car, then you’ll know that these vehicles are very easy to love, but not easy to own.

We started out with our free ownership tooling, so you could digitise your cars history folder, keep a record of work done, services, invoices, MOT’s, road trips, track day tyre pressures - you name it. Anything to do with your car, Custodian is the place to record it. Aside from the obvious benefits of being organised, preserving your car's history, saving yourself time by trawling through paperwork trying to find that service you had in 2011, there’s another significant benefit to all this…

By showcasing your enthusiasm and building a digital garage on Custodian, we can produce a more holistic presentation of your car ownership than traditional brokers. The result being that insurers are more willing to offer cover and terms for exotic or unusual risks.

Take Roland for example, one of our policyholders. His existing insurer wouldn’t allow him to modify his BMW M4. We not only were able to find him attractive cover, but we were cheaper than his original policy, even after adding his modifications!

"I was looking to make some modifications to my BMW M4 but my existing insurer wouldn't cover them, and I was getting silly prices from the price comparison sites. Custodian were able to offer a cheaper price with the modifications than I was paying without them, provided I documented all the modifications in my Digital Garage. It was as simple as logging into my Custodian account and creating a new digital history file, with the invoices and photos, to prove that the modifications had been fitted."

This holistic presentation of your garage unlocks cover that might have previously been unavailable (particularly in the case of modified cars or young drivers).

Given that insurance is mandatory, it makes sense to do what you can to make the process efficient and cost effective. If you’ve already got an account set up on Custodian, then great - get a quote from us. If you haven’t, you can create your free account here.

In the market for a specialist car? Browse our Showroom.

Custodian Insurance in a nutshell:

Everything you'd expect:

From agreed valuations, salvage retention, and choice of repairer, through to European cover.

Tailored for enthusiasts:

Just like our platform, our insurance services are crafted with enthusiasts in mind.

Insurance and automotive expertise:

Backed by top insurers who are excited to offer attractive cover and terms to people who love their car(s).

Modern and simple:

Custodian is giving specialist car insurance a full-restoration. Managing your insurance should be as easy as shifting gears.

Note: Even if your insurance isn't due yet, set your policy start date to your renewal date and we'll reach out to you at the right time.